Investment tax deduction (ITB) is the reduction of profit tax by costs of purchasing, manufacturing, upgrading and reconstructing fixed assets.

* - Transfer devices include facilities designed to transmit electrical, thermal and mechanical energy, liquid and gas substances, signals, information, etc. (e.g. heat and power networks, power transmission and communication lines, pipelines, if they are not part of the fixed asset).

except for coke and oil products manufacturing

at least average monthly labor income from in Moscow (New Moscow factor - 0.74)

except for buildings and structures

last year

over the last 5 years

The fixed assets shall be put on the balance sheet in Moscow and located in buildings and units the applicant has the rights for

Before January 1, 2023 companies can choose - either profit benefit as per the industrial complex (IC), Technopark (TP) status - now 13.5%, or ITD (at the same time ICs and TPs keep the property and land benefits).

The investment tax deduction may become an alternative to the federal Special Investment Contracts (complicated tender procedures for unique technology development and implementation contracts with a mandatory participation of the Russian Government).

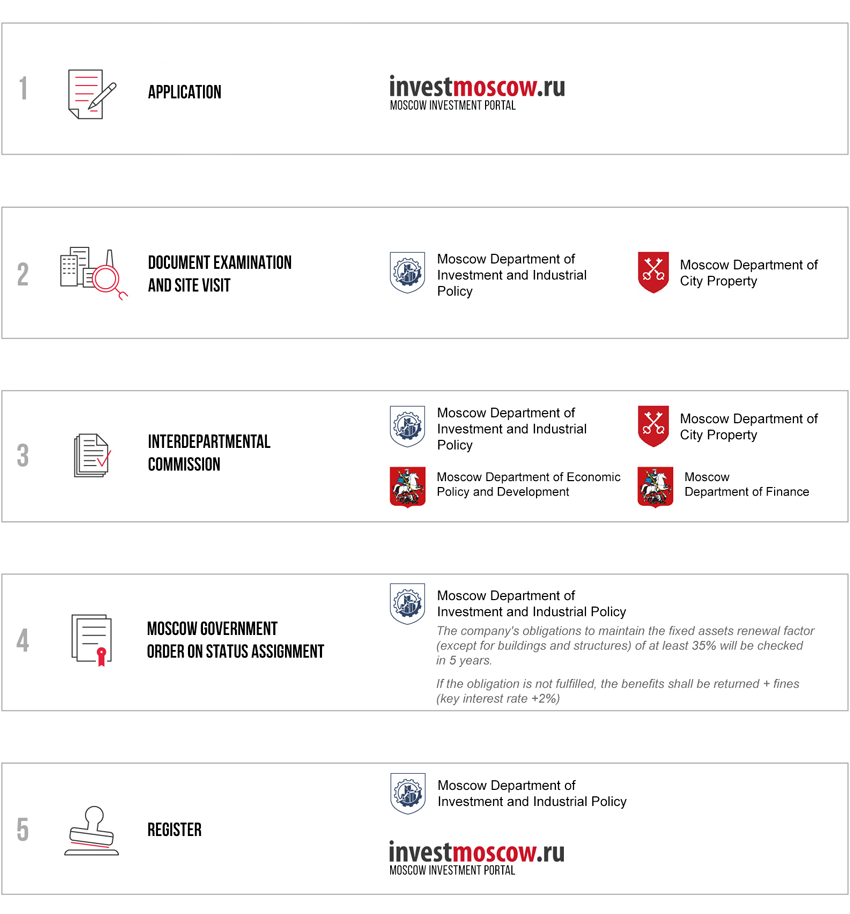

A legal entity applying for the Moscow Investor status shall submit the following documents to the Moscow Department of Investment and Industrial Policy